Platform businesses are not a new phenomenon. It’s a way to optimize a business in the digital age. Modern tech companies like Google, Apple and Amazon use a platform business model to focus on connecting users rather than creating products or services. As these giant tech companies move into the payment industry and offer customers more relevant products and personalized services, banks need to rethink their business model in order to keep up with the competition and ultimately focus on solving customer problems.

The old way of doing business

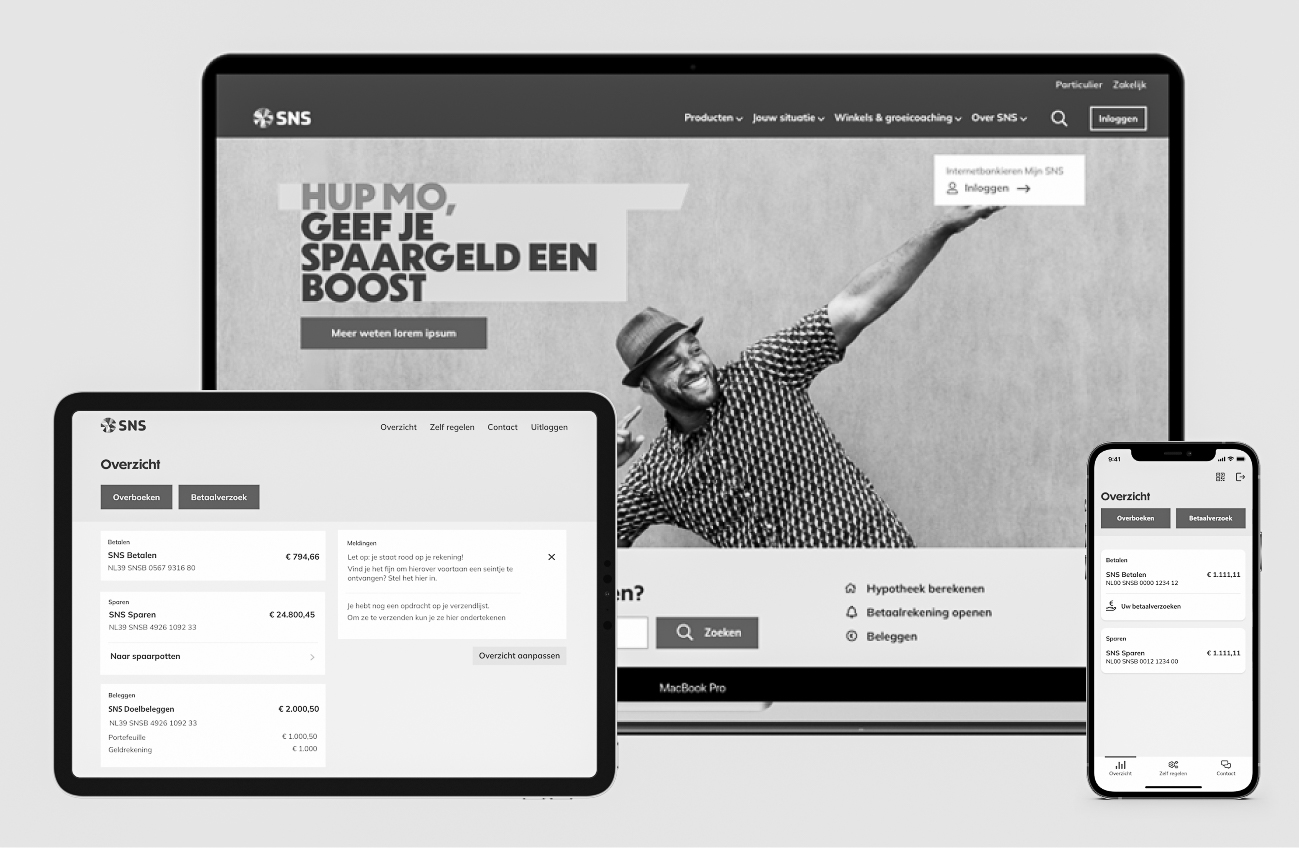

Most companies today operate through a single sided business model, that is mostly focused on delivering one thing, one value proposition. They offer value by either creating them from resources or by providing a service. This approach follows one straight line from beginning to end and is often referred to as a ‘Pipe Model’. Both suppliers and customers are easily defined due to the use of a clear linear path, like water flowing through a pipe. Television only shows you content, school teaches you knowledge and even this blog I’m writing uses the pipe model.

Entering the platform economy

With a platform business model, the focus is on interactions between the producer and consumer. It’s not only about creating stuff and pushing it out. Interactions allow users to create and consume value. Platform thinking creates a non-linear, multi-sided focus. By aggregating the information in a virtual space, a platform can act as a facilitator between producer and consumer. eBay is a great example of this. eBay provides a marketplace where buyers and sellers can easily find each other and do business. The only problem is that they were not fully in control. Implementing different checks and security measures can balance this out. eBay achieves this by using a rating system which indicates the quality of buyers and sellers through user feedback.

Image 1: Pipe-model vs Platform model

What does it take to be a successful platform?

A digital platform helps connect a business to connect with others. This enables the co-creation of products and services on top of the already existing platform. YouTube shows you content and gives you the ability to create your own content, Udemy offers knowledge to consume and to create your own and Medium lets you read blogs or to write and publish your own.

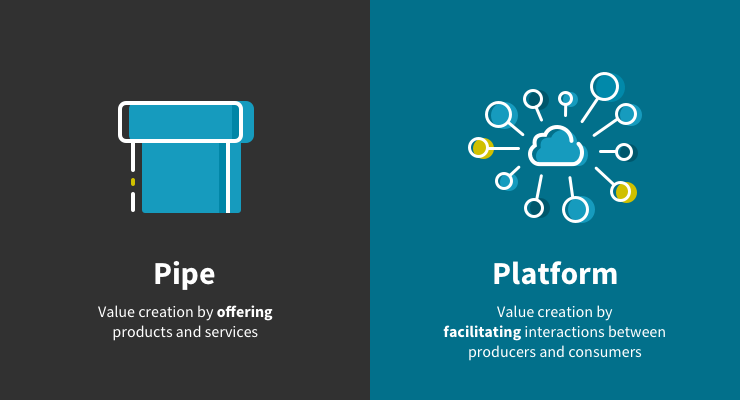

Founder of SHIFT thinking Mark Bonchek and Entrepeneur and author of the blog Platform thinking Sangeet Paul Choudary talk about the three broad properties of a successful platform:

-

Toolbox

-

Magnet

-

Matchmaker

Toolbox

A platform needs to provide the tools required for producers and consumers to interact (and transact). This generates new innovation and increases the number of ways to bring value to multiple parties. The Appstore from Apple or the Amazon webservices are prime examples of this. By providing a platform with tools for external developers they offer the creation of more value. This can then also be adopted in their own platform. A simple example is the flashlight functionality on your iPhone. An external developer created a flashlight app for people to download and use on their iPhone. Apple could see the massive popularity of this app by just looking at the download count. This led to them adding this feature to iPhone itself.

Magnet

When starting a platform, you need to get both producers and consumers on board, otherwise there is no value in using the platform. This is arguably one of the hardest things to do. This can be solved by first acting as a producer and creating enough value that attracts consumers. Can you imagine if the Appstore of Apple was launched without any apps? Nobody would know what kind of potential it offered because there would be no value to use the platform for either consumers or producers. Because Apple launched the platform with 500 apps and added the capabilities to be a producer, third party developers were inspired to offer their own apps on the platform.

To achieve this, it’s crucial for a platform to focus on the design of a social gravity. A term to refer to brands that are so strong, it feels they’re pulling customers into their orbit instead of pushing out advertisements. By showing the value you can offer as a platform, consumers and producers will come to you.

Matchmaker

A platform needs to match producers and consumers by leveraging rich data. For example, TripAdvisor shows you a lot of info about hotels, flights and restaurants like prices but also reviews of other customers’ experience. With all this data you can easily pick out the right travel options for you.

Image 2: Three properties of a successful platform

Evolution of a bank business model

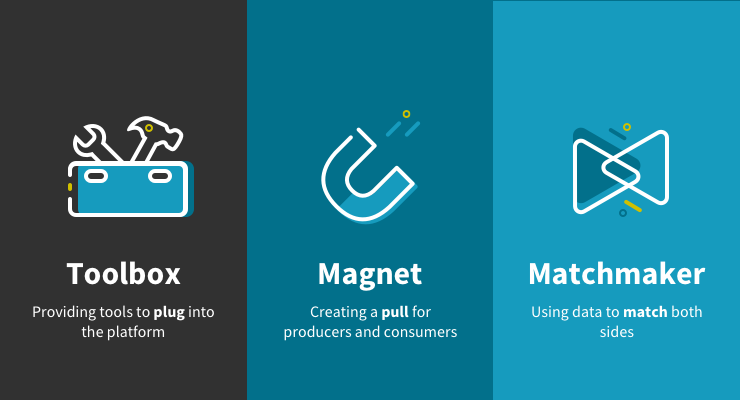

If we look back on how banks have been doing business, they started out with a Pipe model by offering a set of products like a deposit account or a loan. This led to a service for customers to store or withdraw their money somewhere, so banks built many branches (banking centres) each equipped with an ATM. All of them with their own branding and customer experience.

With the decreasing use of physical cash in the Netherlands (because of digitalization), ATMs are becoming more like a burden. They are used less and robbed more.

The three biggest Dutch banks are now working together to create a non-bank dependent network of ATMs. Each of them will become the same, being more efficient and have the same branding and customer experience. This is a step toward platform-thinking strategy even though it’s only limited to one party that will manage this, ‘Geldmaat’.

Moving beyond the first products, banks started to increase their business by offering different products, like investments or being a financial coach. However, when you offer more products you need to hire more experts to help people make informed choices. Creating more products and services may create problems with consistency. This is a crucial part of the customer experience. It is easy to scale up, but it is often harder to keep a consistent level of customer experience across every touchpoint of a business. The omnichannel experience plays an essential role here.

Stay relevant through innovating

Since we are living in a digital age where (almost) everyone has a smartphone, banks need to adapt to stay relevant. A typical approach to optimize a business is by automating various processes. Manual tasks can be digitalised making them faster, cheaper and more effective. By aggregating all the information known about customers (more commonly referred to as big data), algorithms can be applied to optimize the offering to specific customer needs. Multiple uses of big data technologies are helping banks to shift from traditional marketing to more contextual content. This creates a more personalised connection that positively influences the behaviour of costumers.

If banks have all the spending information of a customer, they can clearly determine spending patterns. Let’s say I buy a lot of video games (yes, I love videogames). My bank could offer me some discounts on a particular game I would like. Or by knowing how many games I buy it could easily show game stores how many games are being sold in which month by using anonymous demographic data.

When ING tried to offer this in the Dutch market back in 2014, it received a massive backlash on social media. Emerce wrote an article about it and mentioned that in America several banks are already doing this with great success. This is because Europe has a different view on privacy than America.

Take GDPR that came into effect two years ago. The GDPR aims to harmonize data privacy laws across Europe to protect EU citizens sensitive data and to empower them to have better control of their data. Data Protection Regulations in the US are implemented specifically per sector and are not harmonized. Privacy is often missing from the discussion.

Image 3: EU vs USA

Platform thinking for banks

So banks started out using a pipe model, producing products and services and selling them to their customers. They optimised this by automating processes and using Big Data technologies and, of course, there are many more examples (like machine learning, AI etc). Yet they still follow the same business model of creating something and selling it to customers.

But is this a bad thing? No, not really. But as a survey of McKinsey clearly shows, companies with an offensive platform strategy yield a better payoff in both revenue and growth. They make a company more flexible in their movement to other places in the market. Questrom refers to “platform companies” as common knowledge of the most valuable firms in the world. But platforms themselves will not sell without effort.

With this in mind, some banks are starting to adopt to platform thinking. The three biggest banks in the Netherlands have all launched their developer portal where third party developers (by filling in a lot of paperwork) can use PSD2 APIs to expand on creating customer value. Slowly banks are opening up more APIs that can be used for third parties as a means of addressing their current problem that their producer side is mostly exclusive to their own financial products and services.

Nowadays most large banks have control over a significant consumer base. With the PSD2 legislation (which I briefly explained here) banks are being forced to open up their data so that new players can chip in.

This brings a big risk but also opportunities to banks, especially those with retail market exposure. The risks will be about quickly losing customers to platform competitors like Apple, Google or Amazon that are all moving in the payment industry and can offer better products and services. An example of this is Apple Card which provides a better safety, being completely digital and having no fees.

So is platform just about technology?

No, it’s not just a piece of software or a website. It’s a business model. How an organization creates, delivers, and captures value, in economic, social, cultural or other contexts. Clearly you need the technology to create a website or mobile app but just creating one doesn’t mean you have a platform. It’s about facilitating the exchanges between producers and consumers with a scalable network that offers resources, communities and a market for users to interact and transact.

At Keen Financials we successfully helped banks create a developer portal for internal and external developers. We also work with financials to research customer journeys of products and services that can be translated to APIs that ultimately brings more value to the end user.