Concept

Student Banking App

How we created a new concept for a student banking app and showed how it would function in a real-life banking environment.

Problem

Young people find it hard to save

Many young people have little control over their finances. Research by the Dutch National Institute for Budget Advice (Nibud) states that young people underestimate their monthly expenses by an average of EUR 2,400. Which means that many of them are unable to save.

Approach

User Research

Through interviews and surveys, Keen Financials has mapped the situation of young people and their money in the Netherlands.

Our research shows that young people have little or no insight into their income and expenses. So they have hardly any money left to save. We also found that young people tend to borrow as much as possible or more than necessary.

Result

User needs

– Clear view where my money goes

– Help with saving money

– Insight on my lending behaviour

Solution

A budget app that helps you

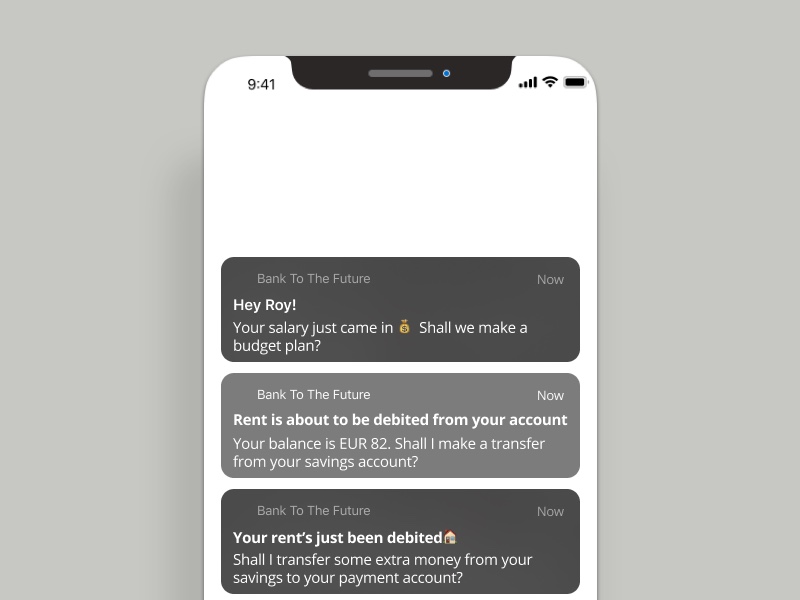

Personal notifications

- Actions based on income and expense

- Perform actions without opening the app

- Direct insights of your financial situation

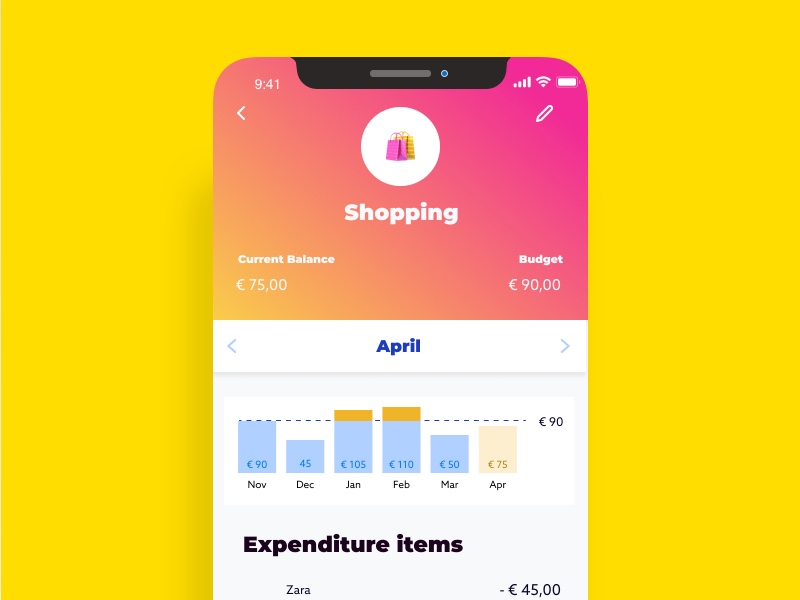

Insights, discounts & tips

- See insights at a glance on specific categories

- Receive personal discount offers for brands that you like

- Quick tips to help you watch your spendings

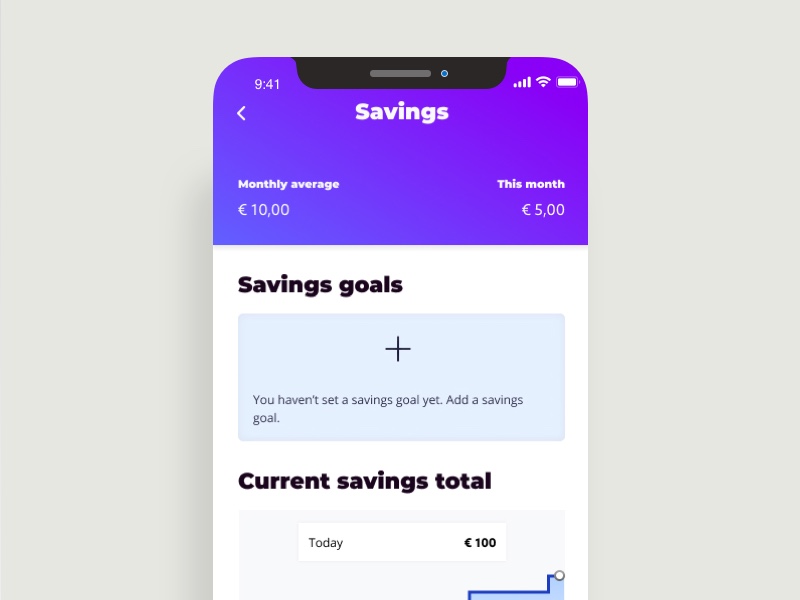

Saving goals

- Create saving goals that will motivate and help you be more conscious of your spendings

- Track how well you are doing reaching your goals

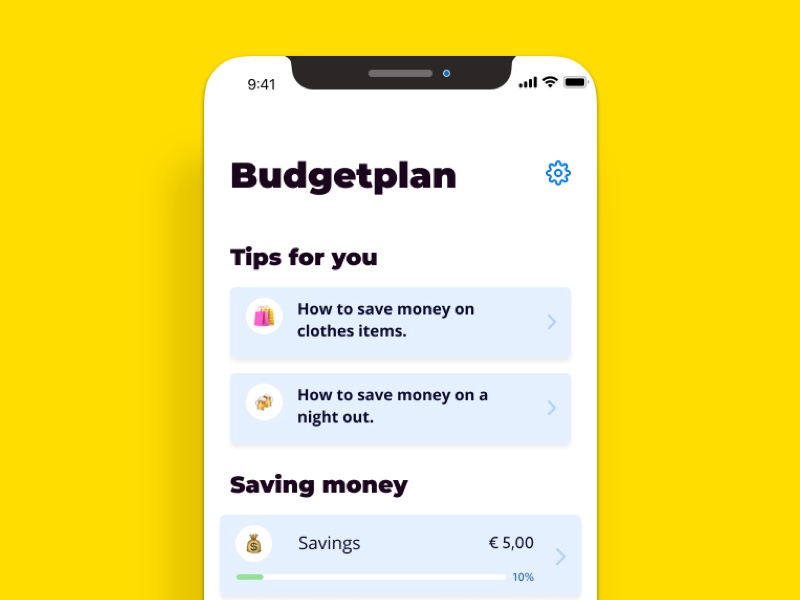

Budget plan

- Set a budget plan helping you save money in the right categories

- Recommendations based on category spendings that can be added or removed with a single swipe.

Get in touch